Investing is complicated.

It can also be a little scary when we consider factors such as volatility in the stock markets, or the nuances of global currency and trade markets.

So most people need help and guidance when it comes to investing money. Your employees are no exception.

Today, I want to discuss why financial education in the workplace is so important, plus give you tips on how to help employees invest their money.

How Employee Financial Worries Affect the Workplace

Figuring out where to invest our money as we filter through an incredible amount of available options and places can be stressful, even for experienced investors. For those who are just getting started, the uncertainty surrounding investing can be so overwhelming that it prevents many newcomers from getting started in the first place.

And while there is ‘risk’ associated with investing, a bigger risk is not investing at all.

“How do I even start? Where should I invest my money? What is the right investment for me?” These are just a few common investment questions facing working Canadians.

But dwelling on these concerns can lead to financial stress among employees in the workplace. And stressed employees often lead to a less productive and unhappy workplace – not desirable for a company’s long-term success.

According to the Canadian Payroll Association’s 2018 Employee Research Survey, 84% of employees are interested in receiving financial education at work. Many employers want to assist their employees in financial matters, but they also don’t know where to begin.

So, let’s figure out some ways to help get you and your staff started on the path to successful investing.

3 Ways to Get Your Team Started With Investing

1. Improve employee awareness around investing

It’s savings – not income – that determines financial wellness.

“But I don’t have enough money to save! I don’t make enough money to invest!” These are common refrains among Canadians who say they are unable to start saving. But surprisingly these objections exist at all income levels – even high-income earners.

Saving doesn’t simply begin once employees start earning higher salaries as they move through their careers. Unfortunately, many people just find more ways to spend their money before they get around to saving it.

The same CPA survey above also noted that 44% of workers are living pay cheque to pay cheque. And almost the same number of respondents (40%) feel overwhelmed by their level of debt.

The primary reason for debt? Increased spending.

So, begin by reassuring your employees that they’re likely not alone if they’re experiencing these types of financial worries and think they are unable to save.

The good news is that there are many ways to begin the act of ‘saving’, but many people may need to adjust their spending habits. And for this to happen, it’s beneficial to start by establishing savings goals and objectives first. Employees first need to set a target, and act accordingly.

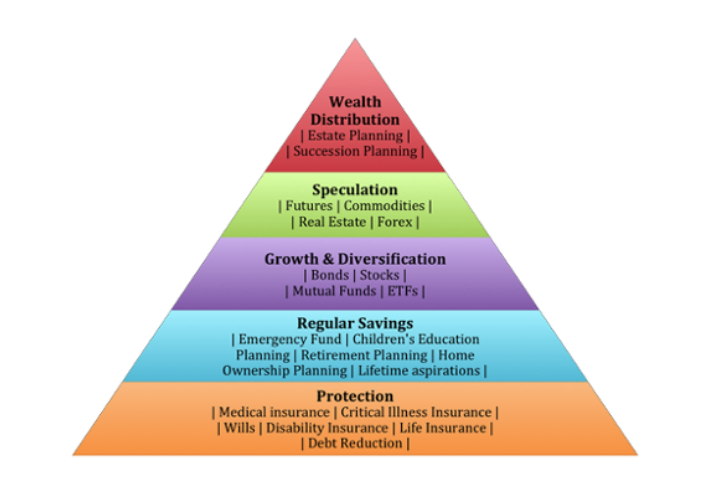

Revisiting the financial pyramid (referenced in a previous post) is a great tool and an ideal place to start.

Once a person identifies what they want or need to save for, then it becomes much easier to figure out what investments they should consider accomplishing those goals.

2. Help employees choose the right investments

Once savings goals are set, employees need to find investments that align with those objectives. In order to select the appropriate type of investment, a person needs to ask themselves: How much time do I have before I need the money? How comfortable am I with risk?

3. Help your team understand time and risk

Every investment should serve a purpose and needs to be aligned with employees’ overall goals and objectives. Regardless of what type of investments somebody elects to use, risk and the time horizon need to factor in to the choice of investment.

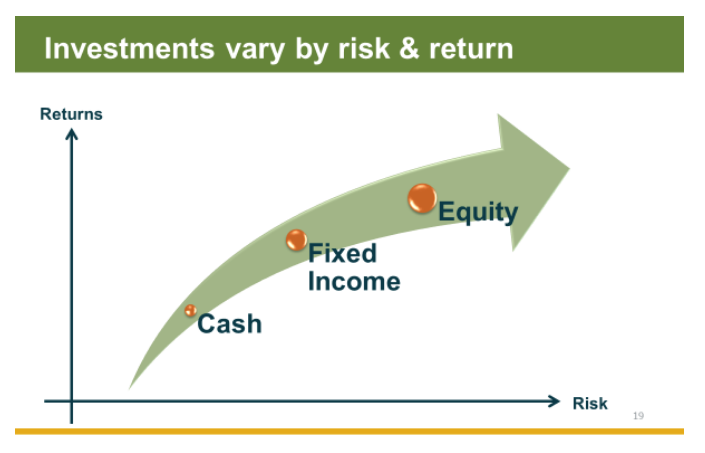

And in an attempt to keep things simple at this time (we could prepare a lifetime’s worth of blog material if we start getting into all of the investing details beyond this) there are three main categories that investments fall into:

- Cash

- Fixed Income, and

- Equity.

On the risk versus return scale, these categories typically look like this:

So if an employee’s savings goals are short-term focused (e.g. an emergency fund) then they should be looking at the lower side of the risk scale when selecting their investments.

Longer term goals, such as a planned retirement in 30 years, would benefit from higher risk funds that have the potential for higher returns over time. These types of investments benefit from time to average out potential volatility from the stock markets during various market cycles.

Most mutual funds will include a blend of all three categories, with the overall allocations dependent on the funds’ overall mandate and investment objective.

Lower risk funds tend to hold higher amounts of cash and fixed income investments. Higher risk funds hold a higher percentage of equity. Balanced funds are just that, holding balanced amounts of categories. Again, this is just a simplification as there are variations in all of the categories, but this is a good place to start.

One of the benefits of using mutual fund type investments is that an investor receives the services of professional money managers. These are the people who actively make the tough investing decisions on our behalf – we just need to select what type of broad investment category we need, and the rest is handled for us.

What else can you do as an employer?

Educate employees using a variety of resources

Provide employees with tools to help them learn more, such as online resources that focus on basic financial planning or investing basics. EAPs (Employee Assistance Plans) or Lifestyle accounts can also provide employees with direct access to credit counselling services and budgeting specialists.

You could also begin hosting financial wellness lunch and learns – formal or informal sessions that aim to help employees prioritize their limited resources based on needs that are important to them.

Often the questions that are raised in these info sessions by an employee will also benefit other employees who find themselves in similar situations. And after covering the financial basics, an additional series that focuses on the intricacies of investing would be a logical step to help your employees accomplish their goals.

Be active in helping employees save

Provide employees with methods to begin saving by taking an active lead and contributory role as their employer. This can be done by offering a retirement plan that includes matching contributions, which benefits employees by increasing their savings. Perhaps more importantly, it will help them to start thinking about life after employment, if they haven’t already done so.

![]()

And don’t forget about short-term savings. You can provide employees the option for payroll deductions to create an emergency or opportunity fund. You can also set up TFSAs (Tax Free Savings Accounts) to help them save additional funds for bigger purchases in a few years (or simply enhance their retirement savings if they’re focused on long-term goals).

In either case, these structured plans, offered through payroll, make savings automatic for your employees. And automatic savings (i.e. paying yourself first) is one of the most useful tools to prevent overspending.

Choose the right company investment plan

Retirement and savings plans are going to include an investment component because employees will need to invest their contributions in some shape or form.

This requirement alone means plans will include an assortment of education and tools from the service provider to help employees make investment decisions. Plus, one of the benefits of creating your own company plan is that you’re able to customize and streamline the investment options to fit the needs of your staff.

These plans are designed to encourage member participation with investment selection, typically using a menu that includes investments in all asset categories and in all regions of the globe.

Plans should also include pre-built portfolio type funds that are based on an employee’s risk tolerance or a specific target date (options that fall under what many refer to as ‘Set and Forget’ investing).

Service providers also realize that many employees would rather not bother making the time (minimal as it may be) or effort to choose their investments. As such, a plan can be designed with a default fund that best fits the overall objective of the plan and the employee.

For example, a retirement plan could use a default fund that correlates with the employee’s planned age of retirement. A TFSA plan could use a conservative or balanced type of fund focused on short to mid-term savings.

Conclusion

Successful investing takes time, discipline, and patience.

Investments should be chosen based on the individual investor’s goals and objectives, which means your employees need to understand what’s most important to them and prioritize accordingly.

As an employer, you can support them by educating them about the risks, giving them the right resources to decide which options are best for them, and customizing your company’s investment plan to fit your staff’s needs.

Above all, when it comes to your company’ bottom line—the more financially well your employees are, the less stressful and more productive they are.

Wondering how you can reduce absenteeism and increase employee morale? Learn how to help your employees improve their financial wellness in this webinar.