Are you currently using any financial wellness tools to help your employees achieve their financial goals? If not, this article is for you. Financial wellness is a crucial component of a comprehensive well-being program and a key component to addressing employee mental health concerns, but one that is often overlooked.

Recognizing the profound impact that financial stability can have on an individual's overall health and productivity offers significant rewards to companies that invest in resources to support their employees' financial well-being. In this blog post, we'll explore various financial wellness resources available to employers seeking to empower their workforce to be financially healthier.

Resources To Guide Employees to Financial Freedom

Nudge - a global financial education platform

Nudge improves employees' financial well-being and boosts engagement with employee benefits by delivering financial education and personalized, timely communication. Nudge offers customized pricing plans that consider factors like the number of employees and selected terms. This approach enables Nudge to tailor its offerings to meet the unique needs of each organization.

Image source: nudge-global.com

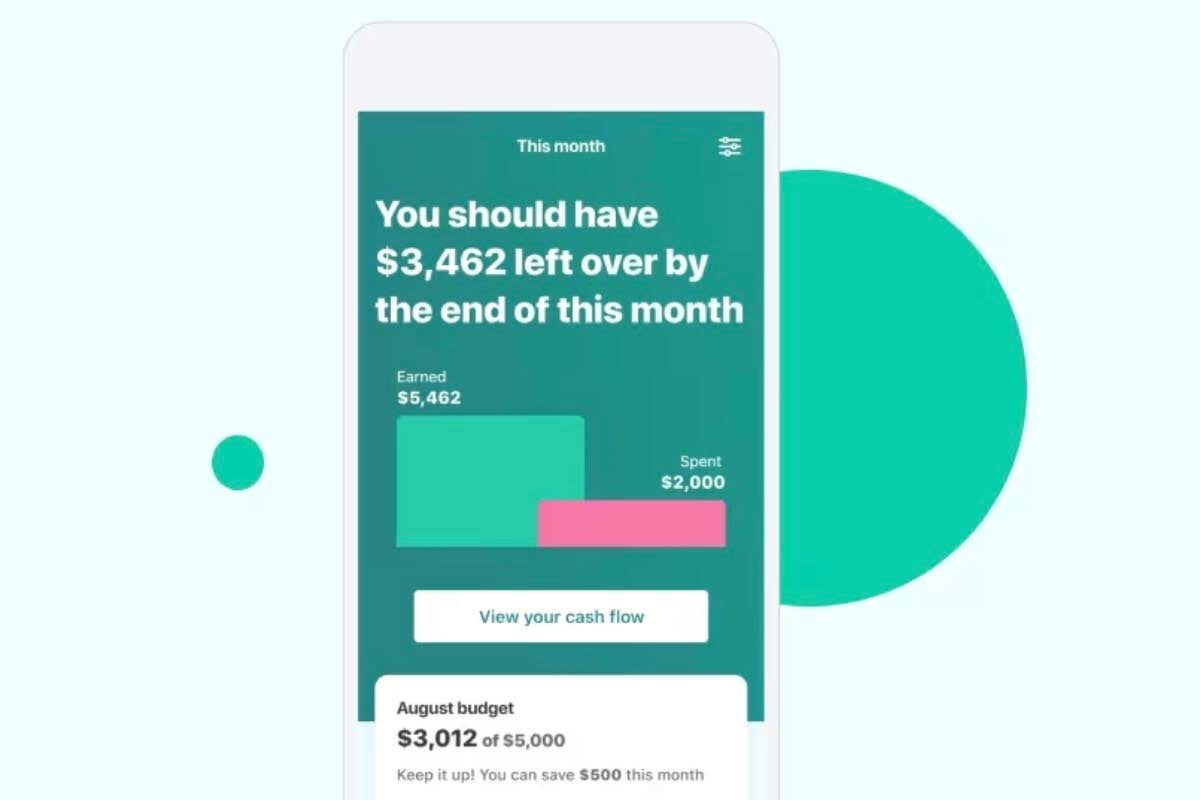

Mint - all financial life in one powerful app

Mint consolidates various aspects of an employee's financial life, including spending, account balances, budgets, and credit scores. Through this robust and user-friendly app, staff can seamlessly access and manage their entire financial portfolio. After creating a Mint account, employees can connect all their bank, credit card, and loan accounts to the platform. This allows them to monitor their account balances conveniently using a unified dashboard. Mint is a free service and can be highly beneficial when used appropriately. However, it is important to note that this is an individual service and does not provide any reporting back to the employer regarding utilization rates or frequently explored topics.

Image source: mint.intuit.com

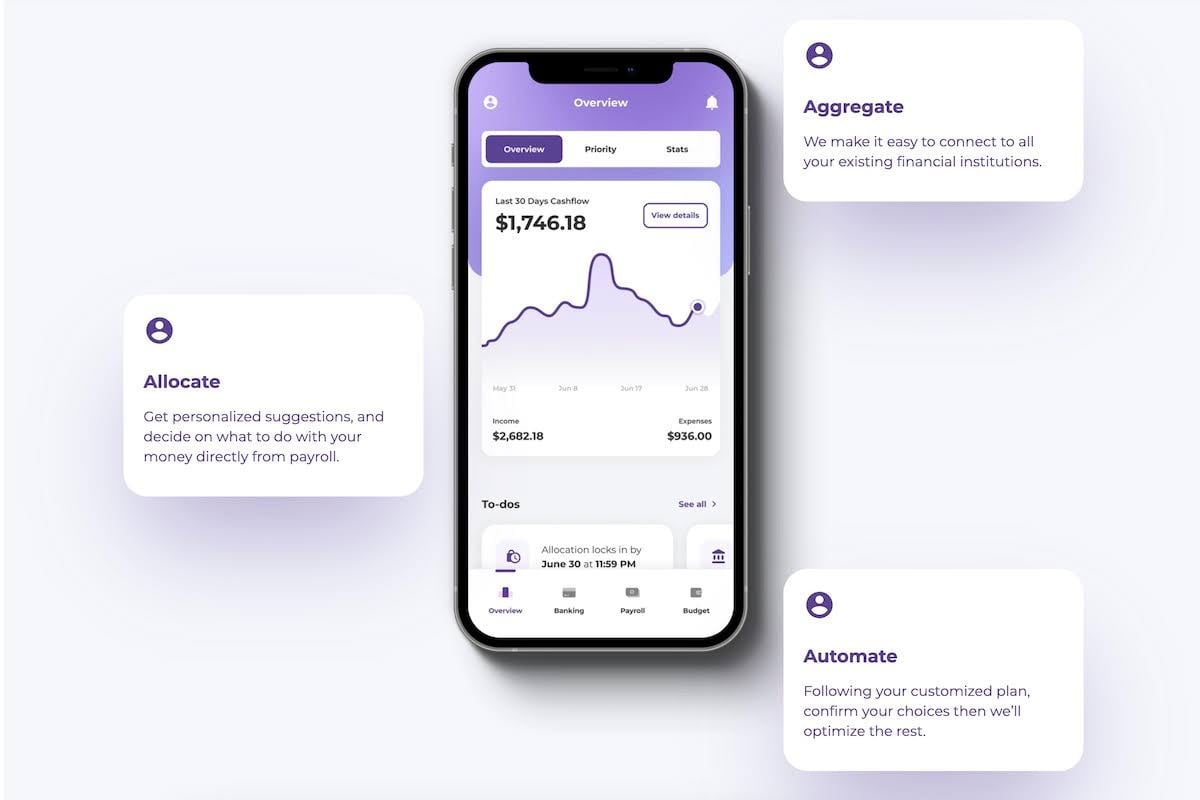

Seedwell - a full spectrum solution for employee personal finance and financial literacy

This fintech firm based in Toronto provides a comprehensive solution for employees' personal finance and financial literacy. They utilize an AI platform to streamline personal finance processes, starting from payroll. The goal of Seedwell is to help employees effortlessly consolidate their financial affairs, make well-informed decisions, and streamline monotonous transfers to achieve complete control over their financial well-being. The Seedwell portal is paid for by employers.

Image source: www.seedwell.io

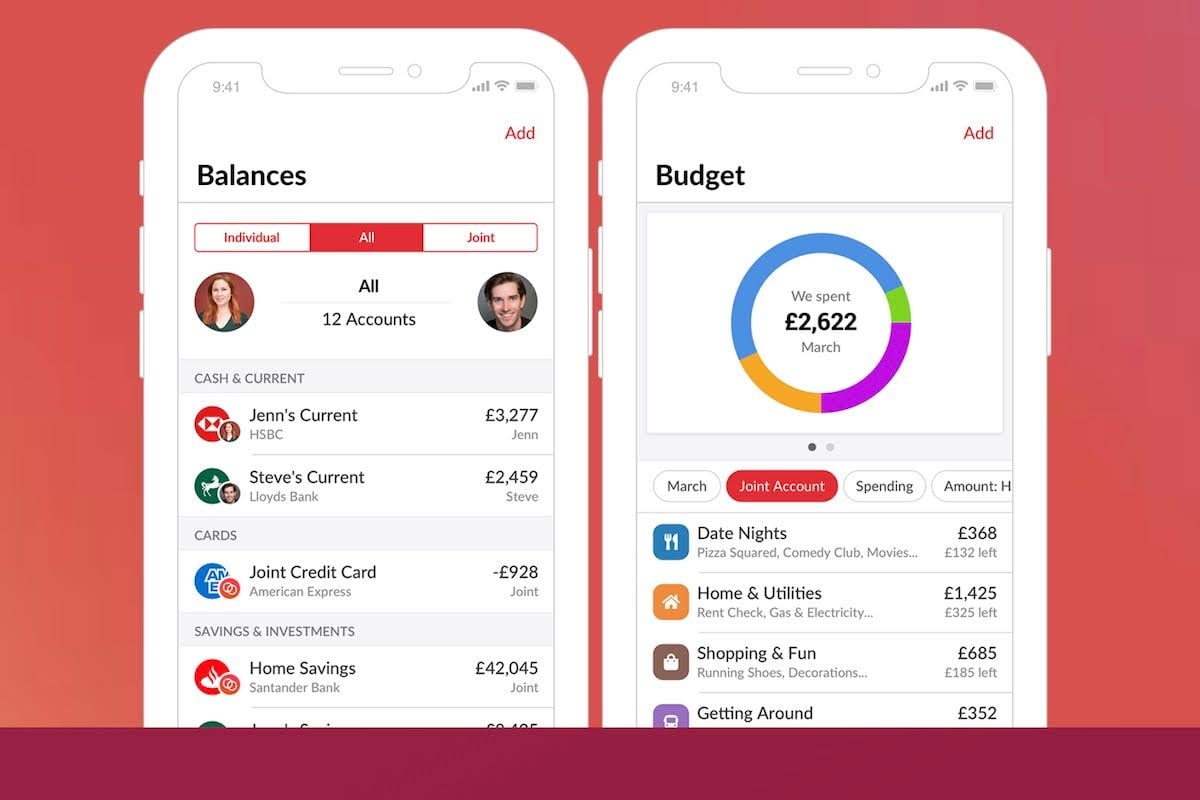

Honeydue - a unique budgeting app for couples who want to manage their finances together

Specifically created for shared finances, the app allows partners to connect multiple accounts such as checking, savings, loans, and credit cards. With over 10,000 ratings on both the App Store and Google Play, Honeydue has been recognized as one of Forbes Advisors' top picks for the best budgeting apps. Best of all, the app is free to use.

Image source: honeydue.com

Qapital - set-and-forget money tools to automate your financial plan

Qapital is a mobile application available on both iOS and Android platforms. It serves as a personal finance tool that aims to gamify users' spending habits, making the process of financial management more engaging. The app offers a 30-day free trial, and after that, users can choose from three pricing packages: Basic ($3/month), Complete ($6/month), and Premier ($12/month).

Image source: jebcommerce.com

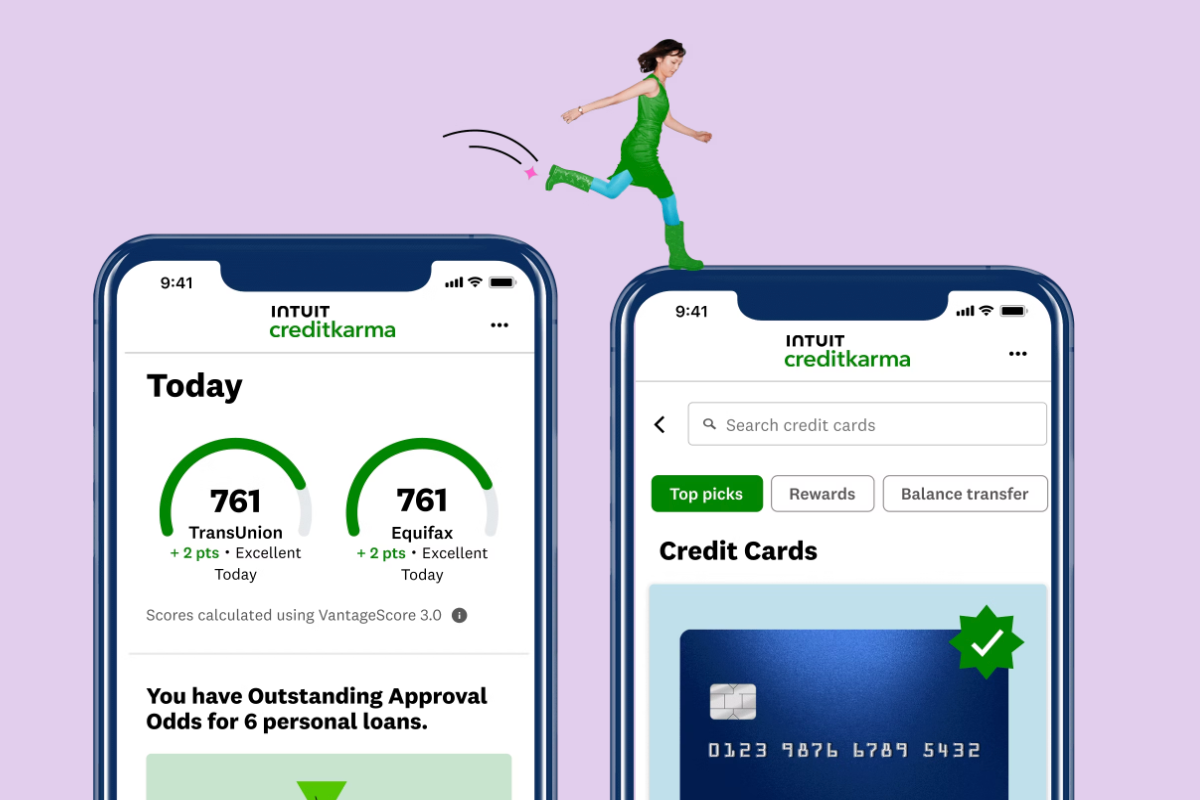

Credit Karma - a credit profile monitoring application

Credit Karma is a widely used credit monitoring application that helps users monitor their credit scores and obtain complimentary credit reports. The app not only provides personalized recommendations for improving credit health but also offers educational materials to promote financial literacy. It includes comprehensive features such as credit score tracking, access to credit reports, tailored suggestions, and educational resources.

Image source: creditkarma.com

Final thoughts

Investing in your employees' financial wellness is a strategic decision with long-term benefits. The satisfaction, productivity, and well-being of your employees are closely tied to your company's financial health.

By creating a comprehensive health benefits plan and adding various financial wellness resources on top, you can create a supportive environment that promotes well-being and empowers employees to achieve your company’s goals.

Prioritizing financial wellness is not just a perk but also a necessity for employee's mental health. It is also crucial to attract and retain top talent in today's competitive job market.

Contact us today to learn more about how we can help you help your employees towards a place of better financial health.