In January 2019, the BC government will introduce a new Health Tax to replace the BC MSP premiums. The goal is to save individuals $900 and families $1,800 a year.

But how will it affect you as an employer? You might be worried about how to manage this extra cost.

So in this blog, we’ll share some key information about the new BC Payroll Health Tax, and how your business can save money in other areas.

How Will the New BC Employer Health Tax Work?

According to the 2018 BC Budget, the new Health Tax will be calculated based on employment income and taxable benefits.

These include:

- Salary and wages

- Bonuses and commissions

- Vacation payments

- Amounts paid by an employer as a top up of salary for maternity and parental leave including the Supplemental Unemployment Benefit (SUB) program

- Stock option benefits

- Employer paid contributions to an employee RRSP

- Taxable allowances and benefits

- Employer paid Group Life Insurance premiums, including Accidental Death and Dismemberment (AD&D), Dependent Life, and Critical Illness.

How Much Will the Health Tax Cost?

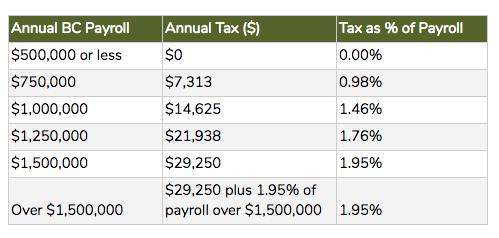

- Those with payroll above $500,000 and less than 1.5 million will pay between 0.98% and 1.76% of their annual BC payroll exceeding $500,000

- Those with BC payroll above 1.5 million will pay the tax at a rate of 1.95%

- Employers with BC payroll costs below $500,000 won’t have to pay the new employer Health Tax.

- BC payroll includes:

- Any payment to employees who report to work at an employer's permanent establishment in BC, and

- Any payment to employees who do not report to work at an employer's permanent establishment, but are paid from or through a permanent establishment in BC.

- BC payroll does not include:

- Any payment to employees who report for work at an employer' permanent establishment that is outside BC.

- Employers that have permanent establishments in multiple provinces, but a central payroll in BC will only subject to the new health tax on the salaries and benefits paid to their employees who report to work in BC.

How will the employer health tax be applied to charitable organizations?

For charitable and nonprofit organizations, special rules will apply. Payment will be calculated on a by-location basis, rather than total BC payroll.

BC payroll health tax for charitable and nonprofit employers will be calculated as follows:

- For $1,500,000 or less, the tax payment for the location will be zero.

- Between $1,500,000 and $4,500,000, the health tax will be calculated as:

- 2.925% × (Payroll for the location - $1,500,000)

- Greater than $4,500,000, the employer health tax will be 1.95% for each location.

- 1.95% × Payroll for the location

*The effective tax rate applicable will range from 0.42% to 1.95%.

What are some other things to consider?

- Employers not subject to BC health tax will not need to file an annual health tax return.Only those employers who owe health tax will be required to file and pay the tax online.

- Employers with BC payroll over $600,000, and charitable/nonprofit organizations with over $1,600,000 at one location will be required to make quarterly instalment payments.

- The health tax is to be levied when amounts are paid to employees - for example bonuses declared in 2018 and paid in 2019 may be subject to health tax in 2019, while the same amount declared in 2018 and paid in 2018 will not be subject to the employer health tax.

- The health tax is also levied on employee remuneration:

- The payments made to independent contractors will not be liable to this tax because they are not employees. It is important to ensure that the employment status is reflected correctly. (See also: Employee or Independent Contractor Factsheet)

- Income received by an individual through sole proprietorship or a partnership is treated as business income not remuneration, therefore, will not be subject to the upcoming health tax.

How Can Your Business Adjust to The New BC Payroll Tax?

The new payroll tax is applied to all forms of taxable compensation. To prepare for this extra cost, employers should review compensation that is paid above your team’s regular salaries. This will help you find ways to reduce the impact.

This could include moving away from bonuses, which are fully taxable, to tax-free forms of compensation, such as:

- Contributions to a retirement plan other than a group RRSP which could include a Deferred Profit Sharing Plan (DPSP) or a Defined Contribution Pension Plan

- Increased health and dental benefits

- Retirement Compensation Arrangements (a type of specialized executive compensation)

- Health Care Spending Accounts (HSAs)

It can also include examining the employee-employer cost sharing arrangement currently in place for taxable benefits such as:

- life insurance

- accidental death & dismemberment benefits, and

- critical illness coverage.

If you’re currently paying for all, or a portion of these taxable benefits, you may want to ask your employees to pay for them via payroll deduction, rather than having the premium amounts added to the employee’s income on their T-4 each year.

Although none of these changes can offset the full impact of the new tax, each small change can help reduce the overall impact on your business.

Conclusion

The new BC Payroll Health Tax will be a challenge for many businesses to adjust to, especially in light of the fact that MSP premiums won’t disappear until 2020.

In order to reduce some of the impact, you can prepare now by making changes to your team’s overall compensation structure. Being proactive means you’ll be ready for the tax implementation in January 2019, and you’ll be able to navigate the change more smoothly.

Next Step:

Download our free resource to learn how the right employee benefits advisor is good for business, and how to choose the best one.

.jpg?height=100&name=Preet%20(1).jpg)