Employee benefits are not just nice-to-have perks; they are essential for attracting and retaining top talent in today's competitive job market.

In fact, a recent survey found that 57% of job seekers consider employee benefits to be one of the most important factors when choosing a job.

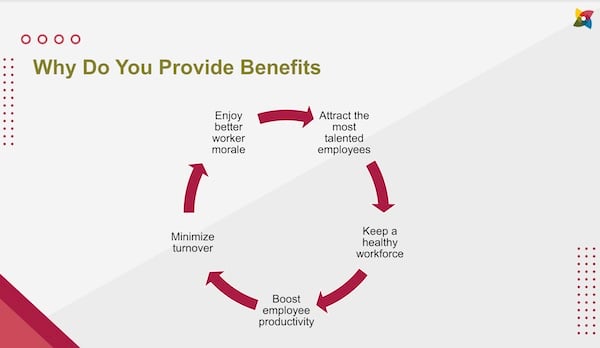

But simply offering employee benefits is not enough; it's equally important to communicate the value of those benefits to your employees. Benefits communication plays a crucial role in promoting a healthy workforce, increasing productivity, reducing turnover, and enhancing morale.

In this blog post, we will explore the importance of the benefits of communication, the challenges that can arise, and the key elements of an effective communication plan.

Why is Benefits Communication Vital to Company Success?

One of the main reasons why benefits communication is so important is that it helps employees appreciate the company's investment in their health and well-being. When employees understand and value their benefits, they are more likely to take advantage of them, leading to a healthier and more productive workforce.

But that's not all.

Failure to communicate benefits correctly can also lead to legal and liability issues for the company. For example, a Vancouver tech company was sued due to insufficient benefits communication.

An employee accepted a job there on the condition that the company's long-term disability (LTD) benefits covered pre-existing conditions. The employee believed that he would be eligible for additional benefits after three months of working without illness. However, he was later denied those benefits because he had failed to complete a health questionnaire at enrollment. The company was found to have done a poor job of communicating their benefits to employees, and as a result, the employee was awarded $93,000 in damages by the BC Supreme Court.

Clearly, employer benefits communication is crucial, but it's not always easy. Several challenges can arise when communicating employee benefits.

Common Challenges of Benefits Communication

- One of the most common issues with benefits communication is a lack of awareness about available benefits. When employees don't know about their benefits, they are less likely to use them, which results in low utilization rates and a lack of appreciation for the company's investment in their well-being.

- Another difficulty with benefits communication is the complexity of benefit packages. Benefit packages can be challenging to understand due to the complicated language, processes, insurance terms, and qualification periods.

- Disengagement is also a problem that employers face. When employers implement benefit plans without giving proper attention, employees may not see the value in participating in them.

- Limited resources can make it hard to effectively communicate benefits information to all employees, especially when there is no HR or designated leadership team to manage the task.

- Additionally, demographic differences, such as distinct communication styles across generations and cultures, can limit the ability to reach all employees effectively. Different levels of coverage and language barriers can create additional obstacles.

- Resistance to change is a common difficulty when implementing new benefit plans or communicating updates to existing plans.

- Lastly, timing is crucial when communicating benefits information. If delivered too early or too late, employees may miss important information or deadlines.

Key Components of an Effective Communication Strategy

Employees' diverse preferences need to be considered when creating a customized communication strategy. This involves identifying innovative and distinctive approaches to deliver benefits information to them. Now, let's examine what successful benefits communication strategies entail.

TLDR: Here are six steps to follow for an effective communication strategy:

- Identify Audience

- Determine Message

- Choose Communication Channels

- Develop Content

- Monitor & Evaluate

- Implement Changes

Let’s take a closer look at each of them.

Identify the Audience

An effective benefits communication strategy starts with identifying your audience.

Ask yourself:

- Who are you communicating with?

- Are you communicating with all employees or certain groups, such as management or executive class?

- Do you have different classes of employees with varying benefits?

- Are there differences between these groups?

- Additionally, consider if you have different divisions or locations across Canada or globally.

Once you have identified your audience, consider their needs and preferences. What type of communication do they prefer? Understanding the demographics of your employees is essential for tailoring your message and communication channels to best reach them.

Determine the Message

Are you protecting employees from financial burdens, promoting healthy living, or providing peace of mind to employees and their families? First of all, determine the purpose of your message.

When drafting your communication material, put yourself in the shoes of a plan member and consider what they would want to know. While providing background and rationale is important, members are primarily interested in what it means for them!

On one hand, your message has to be informative and on the other hand, persuasive. Emphasize the importance of mandatory participation and how it benefits members and their families in the long run.

Explain the reasoning behind any changes regardless of the type of message.

It's also important to consider any restrictions or entitlement periods that may apply to join the plan. By effectively communicating these requirements, you can ensure that members have access to the coverage they need when they need it.

Choose Communication Channels

A one-size-fits-all approach won't work as people learn and understand material differently. Some prefer visual arts while others prefer the written word. That's why you should consider using multiple channels such as print, digital, video, and mobile to reach all employees.

However, you should also evaluate the advantages and disadvantages of each channel as some may be less effective or more effective for certain groups.

Take into account the costs associated with each channel and the impact it may have on productivity. Pulling everyone out of work for an hour to attend a webinar or seminar may not be the best method for this specific communication, especially if it takes two hours out of their workday.

Have you tried seminars?

- In-person or pre-recorded seminars are great during onboarding, plan implementation, reintroducing benefits and explaining essential details such as claim handling or coverage.

- Keep seminars short, using two to three-minute recordings or videos already available from the insurance carrier to avoid overwhelming employees.

- Use seminars to educate employees on common issues, such as using benefits when travelling and coordinating spousal plans.

- Promote wellness and mental health services available under the benefits plan through initiatives like wellness challenges and mental health overviews.

- Consider offering incentives for employee participation. A half-day off or gift card may significantly increase engagement and excitement about the benefits plan.

Develop Content

What content to include in your communication? Will it have a benefits summary, life and long-term disability information, or coverage reviews? Do you need to communicate renewal cost changes or higher disability amounts? Do your employees know what the effect will be on their pay cheques?

Don’t overwhelm them.

Avoid a cookie-cutter approach while developing content. Keep it at one message per communication piece and strive for multiple touchpoints to reinforce your message. Seminars could be great, but back them up with smaller, more focused components like pre-recorded videos and benefit summaries.

Consider the effectiveness! Make sure the content is detailed enough to deliver the intended message without overwhelming employees.

At Montridge, we use a style-based communication platform to deliver bite-sized information through text messages or email. Employees participate in a game-like refresher course on their benefits, with brief quizzes and incentives like gift cards or time off. By incentivizing participation, we get people's attention and help them see the value of the investment being made on their behalf.

Monitor & Evaluate

Are you sure you are reaching your target audience and do they understand your message?

Tracking the results of your communication strategy helps you determine if your goals are being achieved. While there may be negative feedback, it's important to communicate openly and transparently to maintain employees' trust and confidence in you as an employer or leader.

You can measure the effectiveness of your communication through software tools, employee surveys, setting key performance indicators on the plan as a whole and tracking trends over time.

Assess regularly how your employees view the overall plan and how the benefits are being utilized. Use the input from your advisor's analysis to do so.

Implement Changes

Continuously develop new messages and find unique ways to deliver information to your team, rather than simply repeating the same material. By doing so, you can ensure that your employees are informed and engaged with the benefits plan, ultimately leading to a more satisfied and productive workforce.

Ask yourself frequently:

- Are there new channels or technologies that you should consider using to reach your target audience?

- Have you surveyed to gather feedback and better understand the needs and preferences of your employees?

- Are there new types of content that you should include in your communication strategy?

- Have there been any changes to the maximum coverage or other benefits that your employees need to be aware of?

- Are employees able to understand the impact of any changes, such as changes to their payroll deductions?

Through adherence to the six essential steps in developing a comprehensive communication strategy (including identifying the audience, determining the message, selecting communication channels, developing content, monitoring and evaluating progress, and implementing changes), your organization can effectively achieve clarity, maximize the utilization of benefits, engender gratitude from your employees, and ultimately foster a healthy and productive work environment.

The Role of HR, Leadership & Your Advisor

In the past, employee confidentiality has created a barrier for HR leaders to advocate for health. Employees may not want to disclose health issues due to worries that it could be seen to affect their productivity or potential. However, HR leaders have a responsibility to be health advocates.

Consider designating workplace champions to support your benefits communications efforts.

- Health champion for communicating insurance updates and supporting coverage questions

- Finance champion for supporting employer-sponsored retirement and savings plans as well as promoting financial wellness resources and vehicles

- Wellness champion for promoting employee assistance programs, medical second opinion services, virtual healthcare, and digital wellness and creating friendly workplace challenges

- Life Goals champion supporting career growth, facilitating mentorship and supporting life events

Make use of your insurance advisors.

They should provide plan administrator education, communicate the benefits package to employees, assist with problem-solving, stay up-to-date, monitor performance, and help with cost management. Insurance advisors can help you effectively communicate your benefits package to employees, ensuring that they understand their options and have access to quality coverage.

Best of luck with your communication strategy! Remember to follow our tips, and please don't hesitate to reach out to us if you need any support.